In an increasingly connected world, no organisation is immune to cyber risks, especially Not-for-Profits (NFPs). While many NFPs may feel protected by their smaller size or charitable mission, cyber criminals increasingly see them as easy targets.

At ITConnexion, we are committed to delivering future-ready, secure IT solutions tailored for Australian NFPs. We believe cyber resilience is a crucial part of every NFP’s digital transformation journey, not only to protect sensitive data and operations, but also to ensure long-term trust and impact.

One way to strengthen resilience is through cyber insurance. In today’s hybrid and digital-first environment, cyber insurance is no longer a luxury, but a necessity. However, many NFPs struggle with the cost and complexity of these policies. The good news? You can take clear, practical steps to minimise premiums without compromising your protection.

Why NFPs Need Cyber Security Insurance

Rising Cyber Threats

Cyber criminals are no longer focused solely on large enterprises. NFPs, often operating with limited defences, are increasingly being targeted. As highlighted by cyber.gov.au, phishing and ransomware attacks on NFPs are on the rise due to perceived vulnerabilities.

Data Breach Liability

A single data breach can expose sensitive donor, client, or health data. It triggers legal obligations under the Privacy Act 1988, along with significant financial, operational, and reputational consequences. Cyber insurance helps cover the costs of mandatory breach notification, legal action, forensics, and remediation.

Business Interruption

A serious cyber incident can bring daily operations to a halt, affecting not only service delivery, but also crucial fundraising efforts. With the right policy, insurance can help recover lost revenue and manage the financial impact of downtime.

Compliance Requirements

As outlined by Community Directors Australia, NFPs are facing stricter data privacy obligations and compliance pressures. Cyber insurance can support this effort by offering audit trails and demonstrating to regulators and funders that you are proactively managing risk.

Beyond these benefits, cyber insurance also helps NFPs manage key challenges such as limited budgets, complex policy terms, and the operational burden of meeting insurer expectations.

What to Look for in a Cyber Insurance Policy

Not all cyber policies are created equal. When selecting coverage, NFPs should look for key inclusions such as:

Data Breach Coverage

Covering incident response, breach notification, forensic investigations, and legal costs.

Business Interruption Coverage

Reimbursing lost revenue and extra expenses caused by cyber-related disruptions.

Reputation Management

Including PR and communications support to help repair reputational damage after an incident.

Cyber Crime Coverage

Essential for modern risks. Protecting against phishing, invoice scams, and ransomware attacks.

Third-Party Liability

Covering potential legal costs if your breach impacts donors, clients, partners, or other third parties.

Strengthen Your Cyber Posture & Lower Insurance Premiums

Cyber insurers often favour NFPs that actively manage their security posture. By taking these proactive steps, you not only reduce your risk exposure but can also lower your insurance costs:

Conduct Regular Cyber Security Health Checks

Routine health checks help identify vulnerabilities before attackers do. A basic IT health check evaluates everything from device security to data backups, patch levels, and more. Building the foundation for improved resilience and stronger insurer confidence.

Educate Employees & Volunteers

Human error remains a leading cause of cyber incidents, regular cyber awareness is key. At ITConnexion, we offer Cyber Security Awareness Training (CSAT) to help staff and volunteers better understand threats such as phishing, ransomware, and social engineering. Well-informed teams are your first line of defence, and insurers take notice when organisations demonstrate an active commitment to staff education.

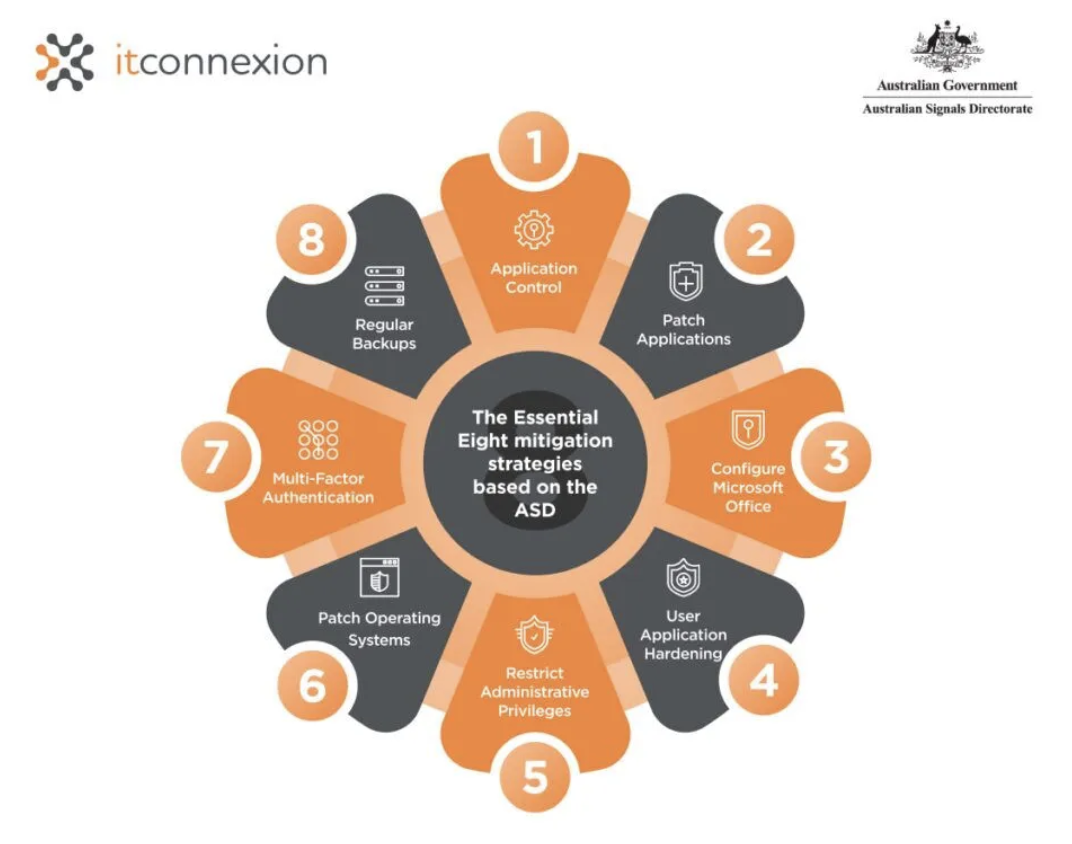

Adopt the ACSC’s Essential Eight Framework

The Essential Eight is one of the most practical and effective standards for Australian NFPs to follow. ITConnexion can help you conduct an Essential Eight audit to assess your organisation’s maturity level, identify gaps, and build a roadmap for improvement. The stronger your cyber posture, the more favourable your insurance terms can be.

Document & Maintain Strong Security Practices

When applying for or renewing cyber insurance, be prepared to provide:

– MFA implementation records

– Backup and disaster recovery plans

– Cyber awareness training logs

– Incident Response Plans (IRPs)

– Asset inventories and patching reports

– Lists of key security tools (EPP/EDR, email filters, firewalls)

Partner with the Right Experts

With ITConnexion, we are customised to tailor your organisation’s needs and help you assess your current security posture, identify priority areas for improvement, and guide you through practical steps to enhance your defences. Whether through security audits, cloud migration, compliance readiness, or implementing essential controls.

Having an IT partner who understands NFP risks and insurance expectations makes a big difference when it comes to protecting your organisation and managing cyber insurance costs. Contact us today!